These Housing Markets Are Closest To Recovering From COVID-19 Setbacks

These Housing Markets Are Closest To Recovering From COVID-19 Setbacks

June 23, 2020

If two months of rising mortgage applications weren’t indication enough, a new report is: the housing market is well on its way to recovering from the recent slump caused by the COVID-19 pandemic.

According to the Market Recovery Index from Realtor.com, both housing demand and home prices are above January’s pre-COVID levels, and housing supply and overall sales “are now following a recovery trajectory,” according to the report.

Nationally, demand for housing is above baseline levels, and recent data from the Mortgage Bankers Association proves as much. Last week, applications for purchase loans were up 13% over the year and 15% over the week. It was the eighth straight week that applications jumped.

As Realtor.com’s Javier Vivas explains, “Homebuyer interest recovered quickly post COVID-19 and remains high despite the weaker economic environment, as low mortgage rates, virtual tools and lockdown lifts have enabled many buyers to continue the home search process, albeit often with adaptations. Housing remains an essential good, and this activity demonstrates that real estate can remain fairly active even during recessionary periods.”

As Realtor.com’s Javier Vivas explains, “Homebuyer interest recovered quickly post COVID-19 and remains high despite the weaker economic environment, as low mortgage rates, virtual tools and lockdown lifts have enabled many buyers to continue the home search process, albeit often with adaptations. Housing remains an essential good, and this activity demonstrates that real estate can remain fairly active even during recessionary periods.”

Prices and inventory

Though home prices had slowed down in recent months (they never outright declined), it appears that trend has ended. Realtor.com shows prices up 4.3% in the last week, up from a 3.7% growth rate in January.

According to Danielle Hale, chief economist at Realtor.com, prices could go even higher if more supply doesn’t hit the market soon. It’s one area that’s recovering—just not at as fast a clip as other indicators. New listings are down 21% over the year and 12.7% below January’s numbers.

“The general sentiment from consumer surveys is that now is not a good time to sell a home because of COVID, economic uncertainty and social unrest, but the data is saying the opposite,” Hale says. “Home prices are back to their pre-COVID pace and we're seeing listings spend slightly less time on the market than last week. But the housing market still needs more sellers in order to meet the surge in demand. Looking forward, if we don’t get the inventory we need, we'll see prices rise even more and homes sell faster later this summer.”

Recovery by market

The numbers certainly point toward recovery for the housing market, but real estate is local, and some metros are showing much stronger signs of recovery than others.

According to Realtor.com’s data, Las Vegas and Denver have bounced back the most thus far, followed by Boston, San Francisco and San Diego. Here’s a quick look at the most-recovered markets so far.

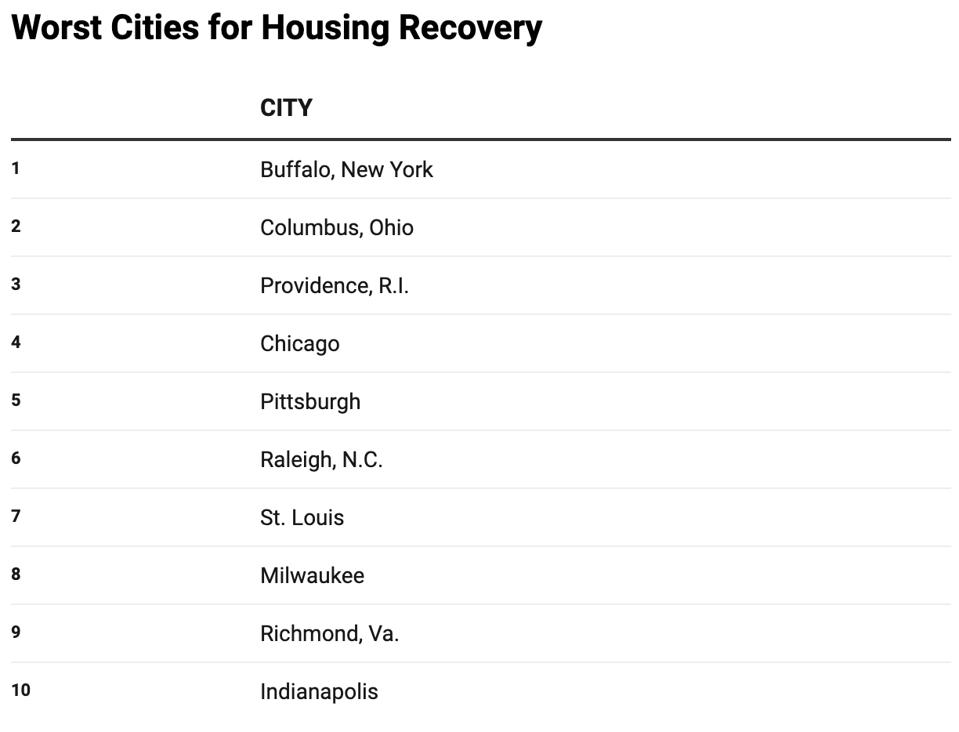

On the other end of the spectrum is Buffalo, New York, which came in with a recovery index of 61 (100 is the baseline) and Columbus, Ohio (recovery index of almost 81). Other cities at the bottom of the list were Providence, R.I., and Chicago.

On the other end of the spectrum is Buffalo, New York, which came in with a recovery index of 61 (100 is the baseline) and Columbus, Ohio (recovery index of almost 81). Other cities at the bottom of the list were Providence, R.I., and Chicago.

Price-wise, Pittsburgh has recovered the most, followed by Minneapolis-St. Paul. Louisville, Cincinnati, and Austin, Texas, also have above-national-average price growth compared to January.

Original article can be found here.

Latest Posts

April 7, 2025

Breathe Easy, Live Safe: Built for Oklahoma Spring

March 28, 2025

Living in Piedmont, OK with Homes by Taber: A Thriving Community with Small-Town Charm

March 12, 2025

The Tunnel to Towers Foundation Delivers Smart Home to Injured Oklahoma Air Force Veteran

March 11, 2025

Why Everyone is Moving to Oklahoma: The Top Reasons to Relocate

February 28, 2025

The Difference Between a Quick Move-In Home and Building From Scratch: Breaking it Down

February 10, 2025

OKC Valentine’s Day Guide: Date Night Inspiration and At-Home Ideas

January 30, 2025

OKC School Districts — Homes by Taber’s Commitment to Excellence

January 29, 2025

Homes by Taber Partners with Tunnel to Towers to Build Functional Home for Disabled Veteran

January 13, 2025

Building a Brighter Future for the Local Community: Taber Cares

Previous Article

Homebuyer Testimonial: Rachel & Chase Nichols

Next Article